Seit 01.01.2020 sind in allen Mitgliedsstaaten der Europäischen Union die sog. Quick Fixes in Kraft, eine EU-weite Mehrwertsteuerreform. Diese haben erhebliche Auswirkungen auf den internationalen Versand, auf Steuerpflichten und auf den gesamten Handel in Europa.

Antonia Klatt

Last Updated on 10 Februar 2020

Die Vorgaben unterteilen sich in:

- MwStSystRL (Mehrwertsteuer-Systemrichtlinien) und

- MwStVO (Durchführungsverordnung zur Mehrwertsteuer-Systemrichtlinie).

Die Änderungen in der MwStSystRL mussten bis 31.12.2019 von den einzelnen Mitgliedsstaaten in ihr eigenes, nationales Recht übernommen werden. Außerdem gibt es noch Änderungen in der MwStVO, diese gelten aber landesübergreifend und müssen nicht erst übernommen werden.

Die Änderungen sind seit 01.01.2020 wirksam und sind betreffen diese 4 Bereiche:

- Steuerbefreiung für innergemeinschaftliche Lieferungen

- Nachweispflichten für innergemeinschaftliche Lieferungen

- Vereinfachte Regelung für Konsignationslager

- Neue Regelungen bei Reihengeschäften

Im folgenden Artikel erfährst Du was sich durch die Quick Fixes alles geändert hat, welche Aufgaben auf einen Onlinehändler zukommen und wo die einzelnen Länder in puncto Umsetzung gerade stehen. Viel Spaß.

Neuestes Update:

Die Europäische Kommission hat Mahnschreiben an EU-Mitgliedsstaaten geschickt, die es nicht geschafft haben die vorgegebenen Änderungen fristgerecht zu übernehmen.

Derzeit haben 22 EU-Mitgliedstaaten die Quick Fixes umgesetzt. (Stand 09.02.2020)

Was ist der Grund für diese EU-Steuerreform?

Die bereits lange geplante Steuerreform, die zu den größten in der Geschichte der Europäischen Union gehört, soll beim grenzüberschreitenden Handel in der Vergangenheit oft aufgetretene vergangene Probleme beheben und das EU-weite Steuersystem sollte generell überarbeitet und auf einen neueren Stand gebracht werden.

Wie bereits erwähnt müssen die neuen Regelungen in der MWStSystRL von den einzelnen Mitgliedsstaaten in das bereits geltende (nationale) Recht eingebettet werden und dementsprechend können sich diese Änderungen in ihrer Auswirkung von Land zu Land unterscheiden.

Buche ein kostenloses Beratungsgespräch

Unsere Umsatzsteuer-Experten freuen sich, dir zu helfen! Buche einfach eine kostenlose Beratung mit unserem Team.

Daher sind auch die daraus resultierenden steuerlichen Aufgaben und Pflichten nicht einheitlich und sollten für jedes Land entsprechend einzeln überprüft werden.

Quick Fix 1: Steuerbefreiung für innergemeinschaftliche Lieferungen

Seit 01.01.2020 wird bei innergemeinschaftlichen Lieferungen neben den Zusammenfassenden Meldungen auch eine gültige Umsatzsteueridentifikationsnummer zu einer rechtlichen Voraussetzung, um eine Steuerbefreiung erhalten zu können. Bis dahin war es lediglich eine formelle Voraussetzung, die Gültigkeit der Steuernummern wurde somit noch wichtiger als zuvor.

Innergemeinschaftliche Lieferung: Als innergemeinschaftliche Lieferung wird ein Steuerbefreiungstatbestand des Umsatzsteuerrechts bezeichnet, nachdem eine grenzüberschreitende Lieferung innerhalb der Europäischen Union von der Umsatzsteuer im Staat des Beginns des Transports steuerfrei gestellt wird.

Wer der Pflicht zur Abgabe der Zusammenfassenden Meldung nicht, nicht richtig oder nicht vollständig nachkommt, dem wird übrigens die Steuerbefreiung für eine innergemeinschaftliche Lieferung versagt.

Zusammenfassende Meldung im Nachhinein korrigieren?

Viele Händler fragen uns, ob man eine ZM auch im Nachhinein korrigieren kann. Wenn rechtzeitig erkannt wird, dass Informationen gefehlt haben oder eben unvollständige Unterlagen eingereicht wurden, sollte der Fehler schnellstmöglich behoben werden.

Auch wenn nicht mit empfindlichen oder die Zusammenfassende Meldung unvollständig eingereicht wurde, sollte den Fehler schnellstmöglich beheben – mit empfindlichen Strafen ist allerdings nicht zu rechnen.

Quick Fix 2: Nachweispflichten für innergemeinschaftliche Lieferungen

Für die Steuerbefreiung einer innergemeinschaftlichen Lieferung ist es unter anderem notwendig, dass die Versendung des Liefergegenstandes ins EU-Ausland nachgewiesen werden. Die Nachweispflicht liegt hier beim Lieferer, jedoch gibt es bisher in den einzelnen EU-Ländern noch keine einheitlichen Regelungen und genau das sollte sich durch die Quick Fixes ändern.

Um die Transportnachweise mit einheitlichen Regelungen in Zukunft effizienter und transparenter gestalten zu können, muss der Nachweis der Beförderung in einen anderen EU-Mitgliedsstaat mindestens 2 übereinstimmende und von unabhängigen Dritten erstellte Nachweise enthalten.

Dokumente über den Versand

- Unterzeichneter CMR-Frachtbrief,

- Konnossement (Seefrachtbrief)

- Transportrechnung etc.

Weitere Unterlagen

- Versicherungspolizzen für den Warentransport,

- Öffentliche Ankunftsbestätigung der Waren (Notar),

- Bankauszüge, die die Bezahlung des Transportes belegen,

- Quittungen über die Lagerung beim Lagerhalter, etc.

Quick Fix 3: Vereinfachte Regelung für Konsignationslager

Bislang gab es keine einheitliche umsatzsteuerrechtliche Regelung für Konsignationslager, und genau das sollte sich 2020 mit diesem Quick Fix ändern. Eine EU-weite Regelung für innergemeinschaftliche Verbringungen von Waren in Konsignationslager trat in Kraft.

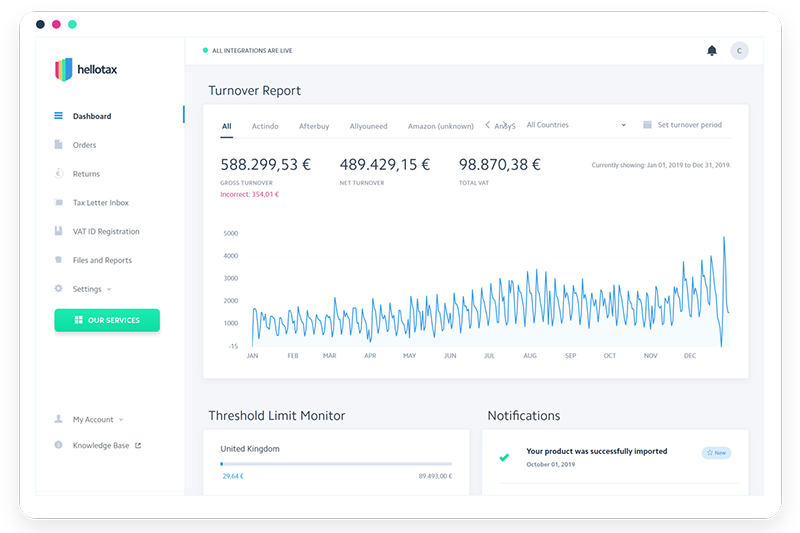

Überwache deine Lieferschwellen

Um zu wissen, was gerade los ist, liefert dir unsere Software zur Automatisierung der Umsatzsteuer alle relevanten Informationen.

Bisher war diese Lieferung beim Lieferer einer innergemeinschaftlichen Verbringung gleichgestellt und wurde dementsprechend beim Käufer als innergemeinschaftlicher Erwerb zu besteuern. Das gilt nun erst ab Entnahme der Ware aus dem Konsignationslager und zusätzlich müssen folgende Voraussetzungen erfüllt werden:

- Identität (vollständiger Name und Anschrift) des Erwerbers muss dem Lieferer zu Beginn der Versendung bekannt sein.

- Das Unternehmen hat im Bestimmungsland weder Sitz, noch Geschäftsleitung, Betriebsstätte, Wohnsitz oder gewöhnlichen Aufenthalt.

- Der Erwerber, an den versendet werden soll, verwendet gegenüber dem Unternehmer bis zu Beginn der Versendung seine Umsatzsteueridentifikationsnummer im Bestimmungsland.

- Die Regelung gilt nur für Warenlieferung innerhalb von 12 Monaten.

- Das Unternehmen zeichnet die Versendungen auf und kommt seiner Pflicht zur Abgabe Zusammenfassender Meldungen nach.

Konsignationslager: Das Konsignationslager ist ein Warenlager eines Lieferanten oder Dienstleisters, welches sich in der Nähe des Kunden befindet. Die Ware verbleibt solange im Eigentum des Lieferanten, bis der Kunde sie aus dem Lager entnimmt.

Quick Fix 4: Neue Regelungen bei Reihengeschäften

In Artikel 36a MwStSystRL werden zum ersten Mal auch Reihengeschäfte klar definiert, diese Änderungen werden als Teil der MwStSystRL in das jeweilige nationale Recht aufgenommen.

Reihengeschäfte: Das Reihengeschäft ist ein Begriff des Umsatzsteuerrechts und bezeichnet Lieferungen eines Gegenstandes, bei der mindestens drei Personen über denselben Gegenstand Umsatzgeschäfte abschließen.

Das äußert sich so, dass mit diesem Quick Fix die Zuordnung der Transportveranwortlichkeit klar geregelt wird, das war bisher nicht in allen Fällen immer eindeutig.

Folgende Regelungen fanden ab 01. Januar Anwendung:

- Wird ein Gegenstand durch den ersten Unternehmer versendet (oder befördert), dann muss die Warenbewegung der Lieferung des ersten Unternehmers zugeordnet werden – die steuerliche Befreiung kann nur der ersten Lieferung zugeschrieben werden.

- Ist ein Zwischenhändler für den Versand/Transport verantwortlich, dann die Lieferung an diesen Zwischenhändler als bewegte Lieferung. Das gilt allerdings nur, wenn er dem Lieferanten seine Umsatzsteuernummer im Abgangsland nicht mitgeteilt hat.

- Versendet/Befördert der letzte Abnehmer in der Handelskette den Gegenstand, dann wird diese Warenbewegung dem letzten Abnehmer zugeordnet – die steuerliche Befreiung kann nur der letzten Lieferung zugeschrieben werden.

Aktueller Status im EU-Mitgliedsstaat

Einige Länder haben die Quick Fixes bereits übernommen, andere nur Teilweise und auch bei der Umsetzung gibt es Teilweise Unterschiede.

Das letzte größere Update gab es am 04.12, als 11 EU-Mitgliedsstaaten die Änderungen übernommen haben. Diese Länder waren: Belgien, Bulgarien, Dänemark, Deutschland, Finnland, Kroatien, Litauen, Malta, Österreich, Slowenien und Ungarn.

Länder A-F

| LAND | STATUS | IMPLEMENTIERUNG + DATUM |

| Belgien | Bestätigt | Aufnahme der Quick Fixes am 24.10.2019 |

| Bulgarien | Bestätigt | Aufnahme der Quick Fixes am 20.11.2019 |

| Dänemark | Bestätigt | Aufnahme am 28.11.2019 |

| Deutschland | Bestätigt | Aufnahme am 29.11.2019 |

| Estland | Bestätigt | Bestätigt am 18.12.19 |

| Finnland | Bestätigt | Aufnahme am 05.11.2019 |

| Frankreich | Bestätigt | Aufnahme am 29.12.2019 |

Länder G-L

| LAND | STATUS | IMPLEMENTIERUNG + DATUM |

| Griechenland | – | – |

| Irland | Entwurf | – |

| Italien | – | – |

| Kroatien | Bestätigt | Aufnahme am 29.11.2019 |

| Lettland | Approved | Aufnahme |

| Litauen | Bestätigt | Aufnahme am 17.10.2019 |

| Luxembourg | Entwurf | Ein Entwurf wurde am 06.12.2019 veröffentlicht. |

Länder M-S

| LAND | STATUS | IMPLEMENTIERUNG + DATUM |

| Malta | Bestätigt | Aufnahme am 04.10.2019 |

| Niederlande | Bestätigt | Aufnahme ist erfolgt |

| Österreich | Bestätigt | Aufgenommen in die Steuerreform 2019-2020 |

| Polen | Entwurf | Aufnahme wurde aufgeschoben |

| Portugal | Entwurf | – |

| Rumänien | Bestätigt | – |

| Schweden | Bestätigt | – |

| Slowakei | Bestätigt | – |

| Slowenien | Bestätigt | Aufnahme ist erfolgt |

| Spanien | Bestätigt | Aufnahme am 04.02.2020 |

Länder T-Z

| LAND | STATUS | IMPLEMENTIERUNG + DATUM |

| Tschechische Republik | Entwurf | Umsetzung wohl erst 2020 |

| Ungarn | Bestätigt | Aufnahme am 12.07.2019 |

| Vereinigtes Königreich | Bestätigt | Betrifft bis jetzt nur Call-of-Stock Vereinbarungen |

| Zypern | – | – |

*diese Liste wird fortlaufend aktualisiert

Umsatzsteuernummer mit MIAS validieren

Seit Einführung dieser neuen Regelungen müssen USt.-Nummern im MwSt.-Informationsastauschsystem (MIAS) der Europäischen Kommission validiert werden (falls das noch nicht geschehen ist). Sowohl die Nummer des Senders, als auch die des Empfängers gilt es hier zu überprüfen.

Hier ein Auszug aus der entsprechenden E-Mail von Amazon:

Die Anforderungen für die Validierung sind in jedem EU-Land unterschiedlich und können aber in der Regel recht rasch erledigt werden. Bei eventuellen Fragen zum jeweiligen Ablauf stehen wir Dir gerne zur Verfügung.